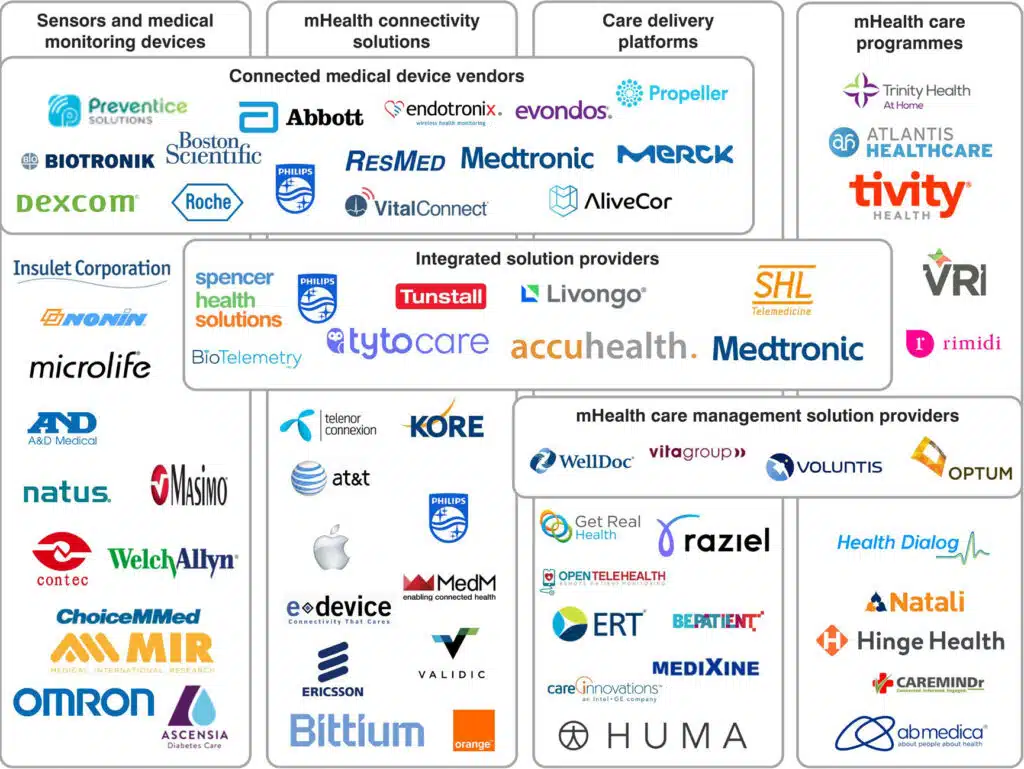

mHealth refers to the application of telecommunications in medicine and includes everything from connected medical devices to digital care programs. The adoption of mHealth solutions in healthcare is driven by a wide range of incentives, related to everything from demographics and technology development to new advancements in medical treatment.

The primary focus of this report is on home monitoring solutions, which are commonly used to manage patients with various chronic conditions such as cardiac arrhythmia, sleep apnoea and diabetes. Other applications include remote diagnostics, compliance monitoring and clinical trials.

The number of remotely monitored patients reached 56.8 million in 2021 as the market acceptance continues to grow. This number includes all patients enrolled in mHealth care programs in which connected medical devices are used as a part of the care regimen.

Berg Insight estimates that the number of remotely monitored patients will grow at a compound annual growth rate (CAGR) of 14.2 percent to reach 126.1 million by 2027. Cellular connectivity remains the de-facto standard communications technology for most types of connected home medical monitoring devices and will account for 61.3 million connections in 2027.

However, the use of patients’ own mobile devices as health hubs has become a viable alternative for remote patient monitoring and BYOD connectivity is already the preferred option in some segments. By 2027 a total of 61.1 million patients will rely on BYOD connectivity.

Berg Insight estimates that revenues for remote patient monitoring (RPM) solutions reached €31.1 billion in 2021, including revenues from medical monitoring devices, mHealth connectivity solutions, care delivery platforms and mHealth care programs.

RPM revenues are expected to grow at a CAGR of 9.5 percent between 2021 and 2027 to reach € 53.5 billion at the end of the forecast period. Connected medical devices accounted for 60 percent of total RPM revenues in 2021. However, revenues for mHealth connectivity solutions, care delivery platforms and mHealth care programs are growing at a faster rate and will account for 55 percent of total revenues in 2027, up from 40 percent in 2021.

There is a strong trend towards incorporating more connectivity in medical devices in order to enable new services and value propositions. Sleep therapy is by far the most connected segment and is dominated by ResMed and Philips. The number of monitored patients continues to grow and has more than doubled since 2018, largely due to the compliance monitoring requirements that have been introduced in the US and France.

Implantable cardiac rhythm management (CRM) has traditionally been the largest market segment, led by companies such as Medtronic, Abbott, Boston Scientific and Biotronik that included connectivity in CRM solutions two decades ago. Berg Insight predicts that three of the fastest growing market segments in the next six years will be glucose monitoring, blood pressure monitoring and connected medication solutions.

Today, the leading connected healthcare players in these segments include forward-thinking incumbents as well as innovative new entrants such as A&D Medical, Abbott, Dexcom, Glooko, Hero, Insulet, MedMinder, MedReady, Medtronic, Omron Healthcare, Propeller Health and WellDoc.

Care delivery platforms are one of the most rapidly developing parts of the mHealth value chain. Care delivery platforms are software solutions that enable the remote delivery of healthcare services. There are various types of care delivery platforms available on the market. General-purpose platforms can be adapted to a wide variety of use cases and are often used as the basis for developing therapy-specific mHealth products. Companies that specialise in this area include AMC Health, Bepatient, Huma, Luscii, S3 Connected Health and Voluntis.

Healthcare systems around the world are currently undergoing a major transformation. The adoption of value-based care is spreading, and healthcare providers are looking for new solutions to provide cost-efficient and improved care. In response to this, the use of data-driven solutions to optimise healthcare is increasing. One example is the use of self-engagement apps that rely on behavioural analytics to coach patients in how to manage their conditions. The demand for remote patient monitoring has been further accelerated by the COVID-19 pandemic.

As a result, we now see an increased acceptance as well as changed regulations in favour of remote patient monitoring. Berg Insight believes that this transformation will spur the adoption of mHealth solutions and expects healthy growth in the mHealth industry in the next six years.