Table of Contents

Thailand Healthcare Market Overview

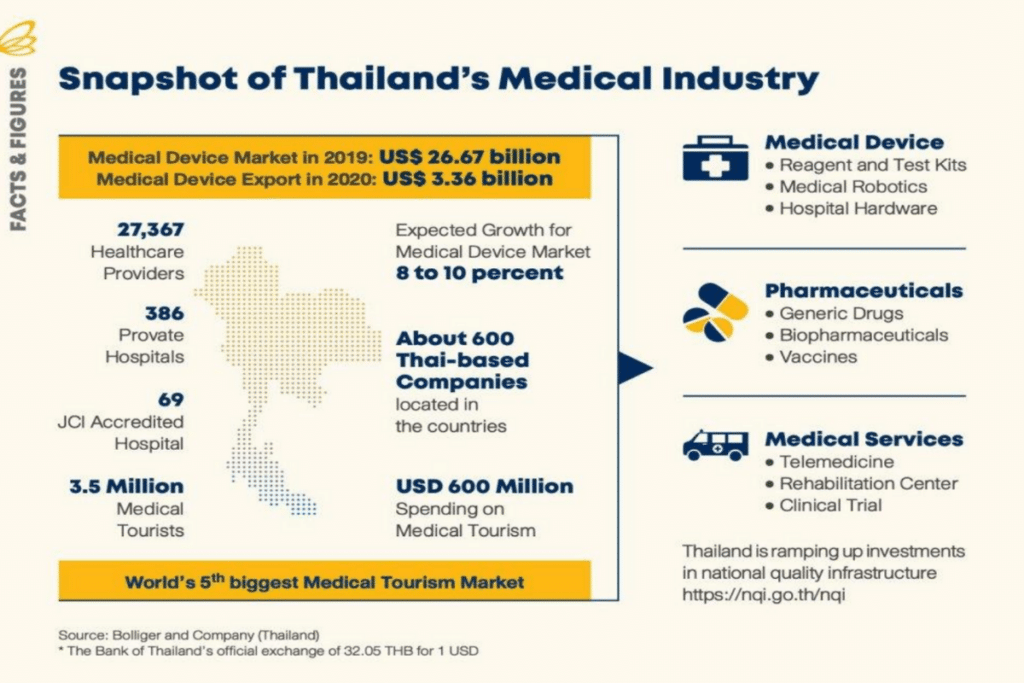

- Healthcare spending in Thailand is expected to reach US$24.6 billion in 2023 which represents 4.0% of Gross Domestic Product with a Compound Annual Growth Rate (CAGR) of 5.4% between 2014 and 2023 according to KPMG which is accounted for by growth in both healthcare and the medical devices market.

- Increase in healthcare expenditure also due to Thailand’s aging population and a large percentage of the elderly have been diagnosed with at least one NCD with almost half diagnosed hypertension9/, followed by diabetes, heart disease, stroke and cancer. These would increase demand for modern, hi-tech medical equipment, especially for diagnostic purposes. The Office of the National Economic and Social Development Council forecasts the population over 60 years old in Thailand will increase from 11.2 million in 2018 to 13.5 million by 2023, and spending on healthcare for the elderly will rise to THB230bn (2.8% of GDP) in 2022 from THB63bn in 2010 (2.1% of GDP). Also, elderly companion robot technology that utilises AI to analyses a patient’s condition for diagnosis is also in growing demand .

- Thailand introduced universal healthcare for its population in 2002. This is provided through a network of over 900 government hospitals and nearly 10000 government health centres.

- The public healthcare system is supplemented by over 350 private hospitals and over 25000 private clinics.

- Thailand is World No. 4th in International Accredited Medical Facilities (with > 67 JCI accredited healthcare providers).

- According to the CEOWorld magazine Health Care Index, Thailand ranks 6th out of 89 countries, ahead of Spain (7th) and France (8th). The ranking takes into account measures such as health care infrastructure; health care professionals’ competencies; cost; quality medicine availability, and government readiness.

- 16th Attractiveness of country as the medical tourist destination (MIT Index)

Medical devices and medical equipment can be divided into three categories as follow

Single-use devices

Are used in general medical treatments and normally not high-tech. The items are meant to be disposed after use. Examples include syringes, hypodermic needles, tubes, catheters, cannulas, disposable gloves and some items used in dentistry or ophthalmology.

Durable medical devices

Normally have a life-span of at least one year. Examples include first aid kits, wheelchairs, medical beds, technical equipment used in medicine, surgery and dentistry, electrical diagnostic tools, and x-ray machines.

Reagents and test kits

Include equipment used to diagnose illnesses and conditions and chemical kits used to test samples drawn from patients. For example, to test for blood type before dialysis, pregnancy tests, and to detect HIV infection.

Thailand Medical Device Market Overiew

- Thailand estimated annual earning of Medical services top in ASEAN at US $4.5 Billion and 2.5 billion foreign patients seek medical treatment in Thailand. Within ASEAN, Thailand is the largest importer and exporter of medical devices by value.

- The domestic medical device market in Thailand is forecasted to be worth US$2.0 billion in 2022, with a Compound Annual Growth Rate (CAGR) of 7.5% between 2018 and 2022F according to a report published by KPMG based on figures sourced from Fitch Solutions reports.

- Thailand had 513 active entrepreneurs in the medical device industry at end of 2020. Of these, 28% were manufacturers, followed by 23% distributers, 17% importers, 9% exporters, 8% parts producers and 7% service providers.

- The majority of Thai manufacturers (43%) produce single-use devices, followed by durable devices (28%), supporting services (6%), reagent and test kits (6%) and others (11%).

- It is estimated that small- and medium-sized enterprises account for 80% to 96% of the total entrepreneurs in Thailand’s medical device industry.

- The value of imports grew from US $ 557 million to US$ 962 million with single-use devices and durable medical devices, such as x-ray machines, ultrasound equipment, electrocardiograms (ECG) and electroencephalograms (EEG), represented the largest share of imports. Other top medical device imports are ophthalmic devices, orthopedic and prosthetic devices ,optical device and hospital hardware

- With the country’s reliance on imports of high-technology medical devices, there are growing demand in 3 potential types of Medtech related categories / products : Digital Platform – AI, TeleHealth , IOT wearable health diagnostic device , Medical Equipment – Medical Robots for use in private hospitals, for example to assist with micro-surgery and in the production and management of pharmaceuticals, assistive device, rehab equipment , hearing aid, Implant & medical Supplies – 3D print Model, Bone graft, knee implant, Dental implant, Stent , etc.

- Also Products in growing demand in light of the pandemic products related to rehabilitation, prognosis and treatment, such as Power Air Purifying Respirators (PAPR), ventilator testers, telemedicine systems, AI systems for pulmonary analysis and dental aerosol suction devices.

Industry trends in short term

Demand for medical devices connected to healthcare and hygiene will increase at home and abroad, supported by:

- rising rates of ill-health due to the increasing prevalence of non-communicable diseases;

- A rebound in the number of foreign patients coming to Thailand for treatment This would be supported Thailand’s ability to offer high quality care and services at its hospitals, To meet increased demand from Thai and overseas patients, many private hospitals plan to increase investment in new buildings and fitting these out new equipment, especially to treat complicated conditions. Many of the larger hospitals are currently expanding their existing premises and/or opening new branches. For example, Bangkok Hospital plans to increase its network from 49 sites to 50 by 2023 and expand its capacity by 172 beds, with a focus on specialist treatment for conditions such as neurological disorders, and bone & joint conditions. Bumrungrad Hospital also plans to open a 202-bed Phetchburi campus, while Kasemrad Hospital is opening a new branch in Aranyaprathet in 2020. Overall, supply is projected to increase by at least 2,000 beds by 2022 which will increase demand for modern, innovative, high quality medical equipment.

- Growing interest in health and wellness by consumers worldwide, including those in Thailand

- Government policy to promote Thailand as an international medical hub.

Regulatory authority and laws governing medical devices in Thailand

Medical devices are regulated by the Thai Food and Drug Administration (FDA) under the of the Ministry of Public Health. The main role of the Thai FDA is to protect consumers’ health, in particular, to ensure the safety, quality and efficacy of health products within its remit, including foods, drugs, narcotics, medical devices, cosmetics, hazardous substances and herbal products.

The main act applicable to medical devices is the Medical Devices Act B.E. 2551 (2008).