Table of Contents

Market Size

The market size of medical devices in Malaysia was valued at $1.9 billion in 2020, and it’s anticipated to grow at a CAGR of 11% from 2020 to 2025, reaching a market size of $3.2 billion in 2025. Below is a table showing the market growth.

| Year | Market size in billion dollars |

| 2020 | 1.9 |

| 2021 | 2.11 |

| 2022 | 2.34 |

| 2023 | 2.6 |

| 2024 | 2.88 |

| 2025 | 3.2 |

In Southeast Asia, Malaysia provides one of the biggest markets for medical device manufacturers.

Digital Health

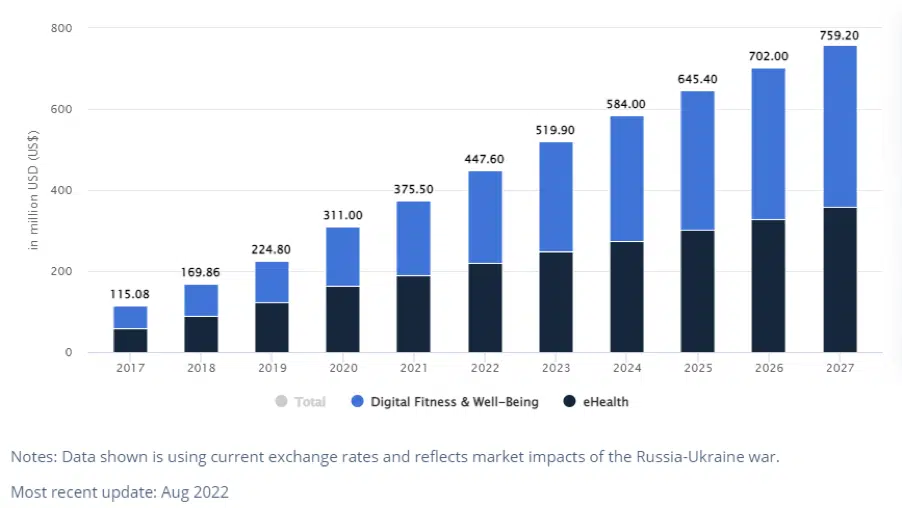

In 2022, the digital health industry is anticipated to generate US$447.50 million in revenue.

The estimated market size of $759.2 million by 2027 is the result of revenue growth projected at an annualized rate of 11.15% (CAGR 2022-2027).

Digital Fitness & Well-Being, with a total revenue value of US$227.50m in 2022, will be the market’s largest category.

Source: Statista

Health Care

In 2022, it is anticipated that the Health Care segment’s revenue will amount to US$105.90m.

Revenue is anticipated to rise at a pace of 18.16% per year (CAGR 2022-2027), with a forecasted market volume of US$243.90m by 2027.

The largest market volume, estimated at US$15,830.00m in 2022, is produced in China. By 2027, there will likely be 7.1 million users in the healthcare market. In 2022, there will be 14.4% of users, and by 2027, there should be 20.4% of users.

It is anticipated that the average revenue per user (ARPU) will be US$22.23.

Diagnostic

The market for diagnostic labs in Malaysia had a value of USD 1011.24 million in 2021 and is anticipated to grow at a CAGR of 7.89% over the forecast period 2021-2027.

The need for frequent checkups and numerous tests is growing as non-communicable diseases are becoming more prevalent. Non-communicable diseases (NCDs) are now more common in Malaysia than they were twenty years ago.

Diagnostic Imaging Devices

The Diagnostic Imaging Devices segment is anticipated to generate US$0.34 billion in revenue by 2022.

By 2027, the market is projected to reach a value of US$0.48 billion, with revenue estimated to rise at a 7.12% annual pace (CAGR 2022-2027). In terms of global comparison, the United States will produce the largest revenue ($11,160.00m in 2022).

In terms of global comparison, the United States holds the largest revenue ($11.160 billion in 2022).

Medical Rehabilitation

Rehabilitation treatments are typically beneficial for patients with illnesses including musculoskeletal, neurological, and cardiologic disorders.

The size of the market for medical rehabilitation services is anticipated to grow at a CAGR of 5.40% from 2022 to 2029 in Malaysia. Services for medical rehabilitation aid injury prevention, treatment, and management are expected to support market expansion.

Market Trends of Medical Devices in Malaysia

Genomics

In recent years, there have been noteworthy efforts made to create genomics tools for a variety of purposes. The execution of established communication and practical advice that a genetic test can offer to patients would be ensured by physicians through the integration of both genomic knowledge and genomic procedures into currently used clinical workflows. The emergence of genomics discoveries has made the new field of customized medicine conceivable. Clinical medicine and specialist care have been transformed by gene therapy and gene-based therapeutic options for a number of unmet clinical requirements.

Blockchain

Blockchain technology is appropriate for a variety of applications in the healthcare sector due to its confidentiality and traceability. Electronic medical records, remote patient monitoring, the pharmaceutical supply chain, and health insurance claims are just a few of these. EHR administration and FHIRChain (Fast Health Interoperability Records) for clinical data sharing are both supported by blockchain technology. Additionally, it is crucial for smart contracts, combating medication forgery, and storing, exchanging, and retrieving remotely gathered biological data.

3D printing

In the healthcare sector, 3D printing is becoming more popular for a variety of uses, including producing bionics, casts for fracture rehabilitation, and lightweight prosthetics. Smart materials and low-cost, lightweight biomaterials are used to improve care delivery and turnaround times while keeping costs down. Utilizing the patient’s own medical imaging, 3D printing technologies are developing the creation of patient-specific models of organs and surgical instruments. Personalized surgical instruments that improve a surgeon’s dexterity and enable better surgical outcomes while permitting quicker and less stressful treatments are another area of use.

Medical device cybersecurity

The potential of increasingly sophisticated cyberattacks is a drawback of the development of smart medical device technologies.

The likelihood that hackers would access patient data without authorization and have possibly harmful side effects on them also grows as more medical equipment is connected with clinical cloud apps. So for Medtech firms, protecting patient privacy and safety is of the highest significance.

Robotics technology

The demand for minimally invasive robotic surgery (MIRS) has skyrocketed over the past five years as a result of significant advancements in robotics technology, driving double-digit growth in the surgical robot market.

This trend line is expected to continue moving upward. Global MIRS procedures are expected to more than quadruple to 2 million by 2025, and the market is anticipated to increase from $5.5 billion (£3.95 billion) to over $24 billion (£17.26 billion).

Robotic use in hospitals has increased as a result of the COVID outbreak. Robots have emerged as a viable, cost-effective way to deliver safe and socially distant preoperative, intraoperative, and postoperative care in an era of constrained medical services and unprecedented demand in hospitals.

Use of Software in Medical Devices (SaMD)

With the help of this technology, people with chronic diseases can collect data and, if they choose, share it with their healthcare providers. SaMD gives consumers the ability to take an active role in their healthcare plans by creating new digital routes for screening, diagnosis, monitoring, and alerting. SaMD provides doctors with the information and flexibility they need to create individualized treatment programs as technology becomes more affordable, potent, and accessible.

Market Restraints of Medical Devices in Malaysia

Ensuring Regulatory Compliance

Strict regulation, traceability, and security are key concerns for medical device manufacturers. Obtaining government support in the form of tax and financial assistance to subsidize research and development is a challenge for manufacturers as compliance and regulatory standards vary from country to country.

Product quality is crucial to reducing product recalls and consumer discontent. The FDA-regulated medical device manufacturing sector gathers all data to satisfy expanding governmental obligations. To systematize every procedure and reduce product recalls, organizations can track devices by their batch number, lot number, or serial number using best-in-class software.

Ineffective business procedures

It’s challenging to oversee every service, function, and resource a company has. Modern technology that enables cross-functional automation, seamless data exchange, and mobile access to files and documents is essential for businesses that manufacture medical devices. Better decision-making and time management are encouraged by the use of software that eliminates silos and supports operations like warehouse management, production, procurement, quality control, shipping, and other fundamental tasks.

Malaysian medical device regulators and laws

Medical devices and IVDs are regulated by the Medical Device Authority (MDA). It is a federal agency of the Malaysian Ministry of Health (MoH). The primary purpose of this law is to address public health and safety issues related to medical devices and to facilitate the medical device trade and industry. The MDA implements, implements, and enforces the Medical Devices Act 2012 (Act 737) under the Medical Devices Authority Act 2012 (Act 738).

Key Players

Major Malaysian medical device market players are Abbott, Medtronic, GE Healthcare, Stryker Corp (Stryker), and LKL International Berhad.

A diversified healthcare products company that manufactures and markets pharmaceuticals, diagnostics, branded generics, and vascular and nutritional products. The Company’s products include specialty pharmaceuticals. medical diagnostic instruments and tests; minimally invasive surgical instruments; and products for veterinary care.

A medical technology company. They offer a wide range of medical devices for the treatment of heart, spine, neurological, vascular, orthopedic, and diabetes. Medtronic is headquartered in Dublin, Ireland. In Malaysia, Medtronic is located in Petaling Jaya, Selangor, Malaysia.

It is a business unit of the General Electric Company. We manufacture and sell diagnostic medical imaging equipment and other medical equipment. GE Healthcare is headquartered in Chicago, Illinois, USA. In Malaysia, we operate from Kuala Lumpur.