Table of Contents

Market size

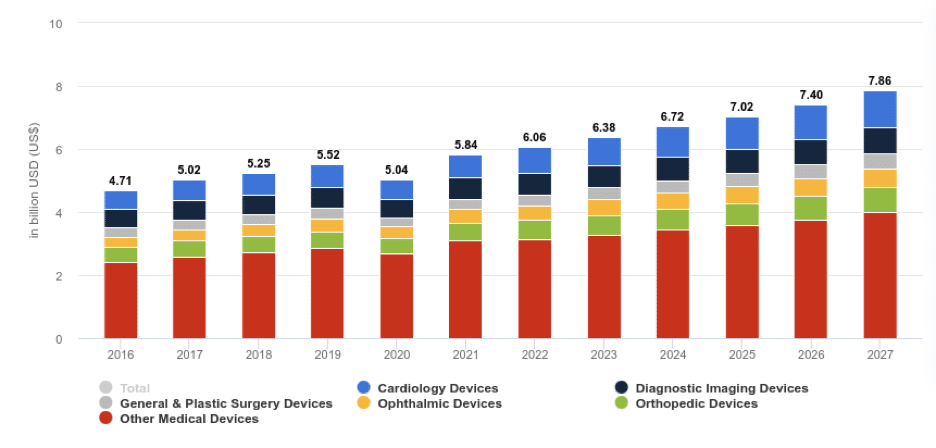

After Brazil, Mexico is the second-largest medical device market in Latin America and can be a profitable target for IVD and medical device manufacturers. The revenue in the Medical Devices industry is anticipated to reach $6.25 billion in 2022. Cardiology devices have the largest market size of $0.82 billion in 2022.

Revenue is projected to show a CAGR growth rate of 6.86% in the forecast period (CAGR 2022-2027), resulting in a market size of $8.71 billion by 2027.

REVENUE BY SEGMENT

In 2021, Cardiology devices had the biggest market share of the medical devices industry in Mexico. It had a revenue of $0.75 billion and is expected to reach $1.18 billion in 2027. Diagnosis Imaging devices closely followed it with a revenue of $0.66 billion in 2021. Below is a graph showing more.

| Medical Devices | 2022 revenue in billion dollars | 2027 revenue in billion dollars |

| Cardiology devices | 0.83 | 1.18 |

| Diagnosis imaging devices | 0.68 | 0.83 |

| General and plastic surgery devices | 0.36 | 0.46 |

| Ophthalmic devices | 0.46 | 0.61 |

| Orthopedic devices | 0.59 | 0.78 |

| Other medical devices | 3.15 | 4.00 |

revenue of medical devices in 2022 and 2027

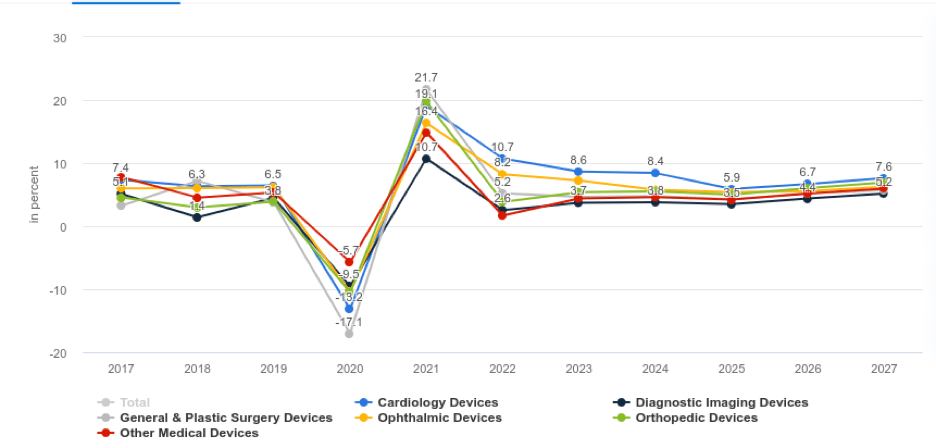

REVENUE GROWTH BY SEGMENT

After a massive decline in 2020 due to COVID-19, the industry grew at a tremendous rate in 2021 and is expected to maintain a high growth rate of over the forecast period (2017 – 2027). For instance, in 2020, the cardiology devices revenue declined at a rate of -13.2% and grew at a massive rate of 19.1% in 2021. General and Plastic surgery devices declined by -17.1% in 2020 and grew by 21.7% in 2021. Below is a graph showing more.

| Medical devices | 2022 growth rate in % | 2027 growth rate in % |

| Cardiology devices | 10.7 | 7.6 |

| Diagnosis imaging devices | 2.6 | 5.2 |

| General and plastic surgery devices | 5.2 | 5.8 |

| Ophthalmic devices | 8.2 | 6.2 |

| Orthopedic devices | 3.8 | 7.0 |

| Other medical devices | 1.7 | 6.0 |

The growth rate of 2022 and the projected growth rate in 2027

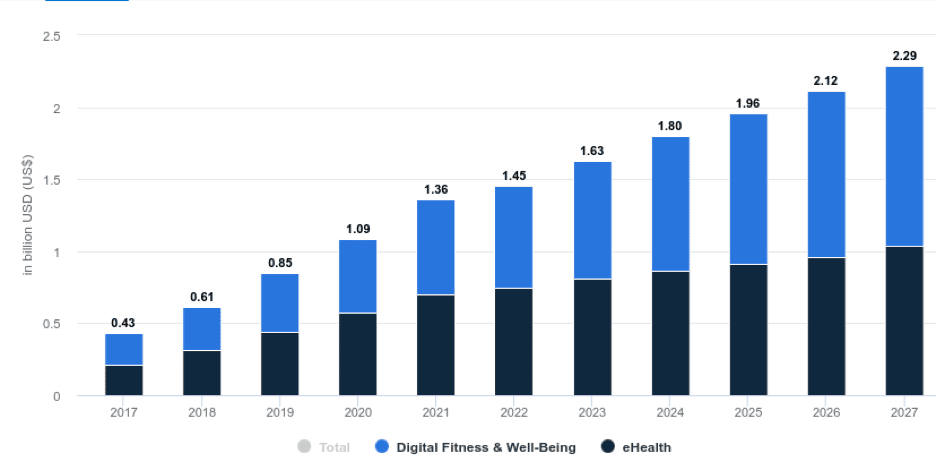

Digital health

Revenue in the Digital Health market is expected to reach $1.45 billion in 2022. Revenue is projected to grow at a CAGR of 9.54%, resulting in a market volume of $2.29 billion by 2027. The average revenue per user is anticipated to amount to $26.45 billion. In comparison to the global market, most revenue is generated in China ($46 billion in 2022). The eHealth segment is the biggest market with a total revenue value of $0.75 billion in 2022.

REVENUE BY SEGMENT

In 2021, eHealth had the biggest revenue of $0.7 billion while Digital fitness and well-being had a revenue of $0.66 billion. However, Digital fitness and well-being is projected to grow at a high rate over the forecast period, reaching a market volume of $1.26 billion by 2027, while eHealth is projected to reach a market volume of $1.03 billion by 2027. Below is a graph showing more.

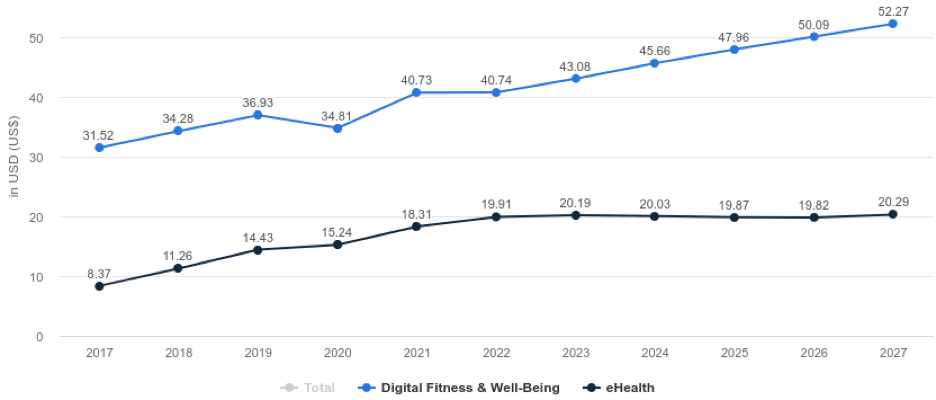

AVERAGE REVENUE PER USER BY SEGMENT

In 2021, DIgital fitness and wellbeing had a high revenue per user of $40.73 as compared to eHealth which had a revenue of $18.31. The average revenue per user of Digital fitness and well-being is projected to reach $52.27 in 2027, while eHealth is projected to reach $20.29 in 2027.

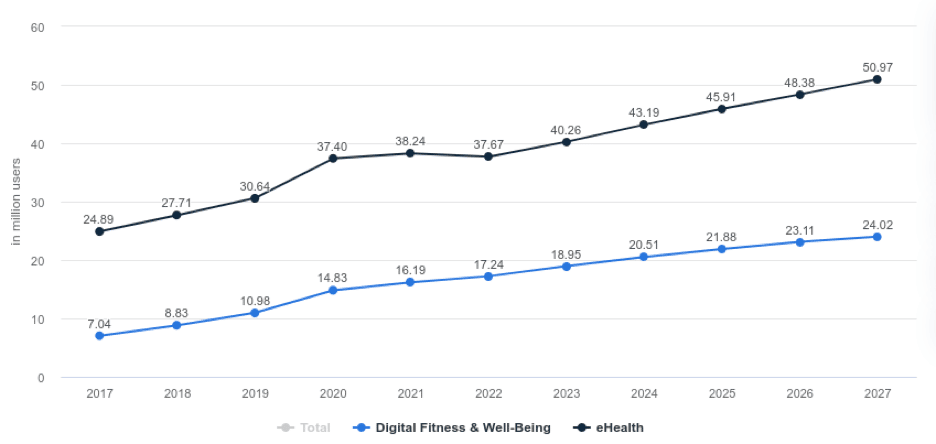

USERS BY SEGMENT

Ehealth had a high number of users $38.24 million in 2021 while Digital fitness and well-being had $16.19 million users in 2021. Below is a graph showing more.

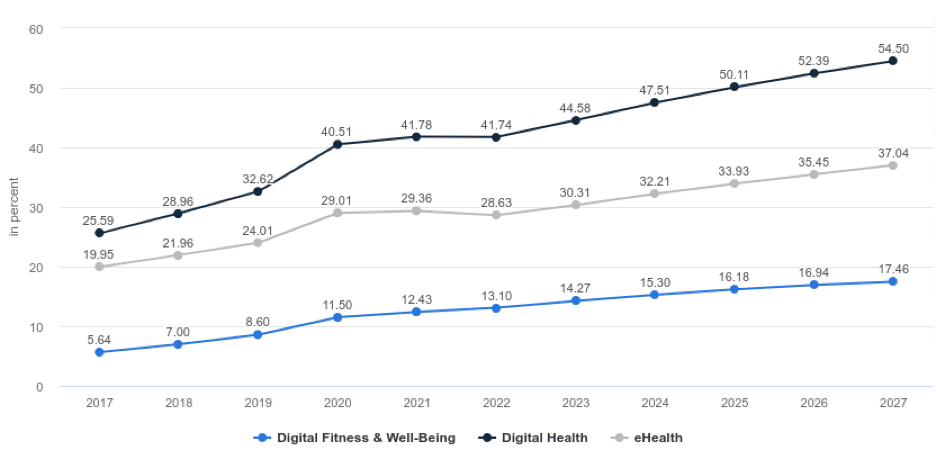

PENETRATION RATE BY SEGMENT

EHealth had a high penetration rate of $29.36% in 2021 while digital fitness and well-being had a penetration rate of 12.43%. Below is a graph showing more.

Market Trends

The Mexican medical device industry is quite sophisticated and values innovative and high-quality medical technologies. Cost-effective advanced products that deliver strong healthcare outcomes are expected to perform better. Medical devices in the areas of diagnostic imaging, preventative care, diagnostic imaging, dental products, orthopedics, diagnostic imaging, and prosthetics are in greatest demand.

There are many opportunities that exist in the Mexican medical device industry. The Mexican medical devices sector imports nearly 90% of medical devices for domestic consumption. The need for locally manufactured products has created a market opportunity for local producers.

Mexico imports medical devices from all across the world, with most devices imported from Asia, the United States, and Europe. Despite this, there is a medical device manufacturing industry located in Baja California. This region is home to more than 60 companies and accounts for 36% of medical device exports.

Business challenges in the political landscape, infrastructure, the rule of law, regulation, and compliance are being met with goals to fight corruption and training for the use of advanced medical devices for domestic consumption.

Market Restraints of Medical Devices in Mexico

Regulatory timeframes are one of the obstacles to entering the Mexican market. Regardless of whether COFEPRIS, the Mexican regulatory body, has several registration routes, the process of submission is time-consuming and approval can take a long time leading to a backlog of submissions. However, COFEPRIS has been working to refine its registration process. Also, importers can face tough competition from US manufacturers, which holds more than 50% of the Mexican import market.

Also, registering a medical device or IVD in Mexico is challenging for non-Spanish speakers. COFEPRIS provides limited guidelines about the registration process in English and requires all communication and documentation to take place in Spanish.

Market Drivers

The Mexico medical devices industry is mainly driven by the following factors.

- The rising prevalence of chronic diseases is expected to boost the demand for Medical Devices in Mexico. For example, the National Library of Medicine reported that after about 50 years old, diabetes was extremely common in Mexico– for example, 26.9% of women and 23.8% of men aged 65–74 years reported a diagnosis. By comparison, ischaemic heart disease was reported by 3.0% of women and 4.8% of men aged 65–74, a history of stroke by 2.3% and 2.8%, respectively, and a history of cancer by 2.1% and 1.3%.

- A shift toward homecare settings is also expected to boost the demand for Portable Medical Devices.

Key players

The industry is highly dominated by international players.

- Medline

- Medtronic

- Johnson & Johnson

- Philips

- GE Medical Systems

- Siemens

- Smiths Medical

- Cardinal Health

- Becton Dickinson

- Abbott Laboratories

- Stryker Corp